Homebuyers across the United States currently have something to smile about as mortgage rates are now at the lowest they have been in years. This is a significant shift from the trend that was witnessed throughout 2018 and earlier in the year when all factors pointed towards an increase. While the first quarter of the year was not so pleasing, the market has taken a turn-around that has seen it attract lots of attention. Generally, the interest rates on mortgages have always impacted the market as they dictate the financing abilities of potential homebuyers. Higher rates tend to be marked with low demand for housing with lower rates leading more people into the market.

At a time when the analysis on the current housing market shows that the interest rates are at the lowest they have been in over a year, it is a suitable opportunity to get into the market. The best news is that this is not a sudden drop that is bound to shift soon as industry forecasts show that the mortgage rates are holding stable. For homebuyers who have been waiting for the opportune time to get into the property market, this is a ripe time to make that purchase. Fortunately, many people have taken the cue as reports show an increased demand for houses across the nation.

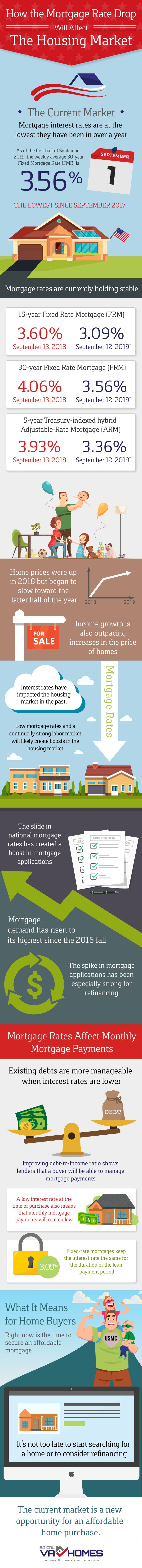

Averagely, mortgage rates are about 1.25% lower than they were a year ago, and this means big savings for you as a borrower. A case in point is the popular 30-year fixed-rate mortgage that had a rate of 4.06% last year was at a low of 3.56% as of 13th September this year. The 15-year fixed-rate mortgage has equally dropped from 3.60% to 3.09% within the same period, as the 5-year treasury-indexed adjustable-rate dropped from 3.93% to 3.36%. All these factors become more suitable considering that the national income growth is growing, meaning there is a stable economic environment to sustain this drop.

For homeowners who already have a mortgage, embracing refinancing in the current market is a practical aspect that is bound to lead to major savings. This is because, for most of the past five years, the mortgage rates have been higher and on average, above the 4% mark. As such, there are lots of people who have to bear a more substantial burden as they seek to pay off the mortgage and enjoy the freedom of being debt-free homeowners.

The practicality of refinancing is higher for those who took their mortgages less than two years ago. Primarily, this is based on the fact that they still have lots of years that they can capitalize on for their advantage. It is possible to save thousands of dollars by making this move and avoiding the extra burden of the past rates when you took the mortgage. According to professionals, when thinking about refinancing, a rate that will be lowered by at least 75 basis points is worth the shift and should be highly considered. Therefore, before making a sudden move, it is vital to calculate the figures and other factors such as loan-origination fees and time.