A record number of home buyers backed out of deals in July over the uncertainty of the upcoming presidential election and sky-high prices.

Roughly 59,000 buyers canceled their home-purchase agreements in July, accounting for 15.8% of all homes that went under contract last month. That is the highest percentage ever recorded of monthly pending home sales that fell out of contract. In comparison, only 14.7% of home purchases fell through in July 2023, per a new report from Redfin.

It is important to note that homes that fell out of contract in July did not necessarily go under contract in the same month.

One of the reasons why contracts fell under is due to the sky-high housing costs. As of June, the median sale price of a home in the US was $442,451. However, home prices could go up, depending on the location. In the Bay Area, for instance, the median price for a single-family home has hit $2 million.

Another reason attributed to the large share of canceled contracts was economic uncertainty due to the upcoming presidential elections.

"When rates finally dropped, buyers got excited, and we saw more activity," Nicole Stewart, a real estate agent with Redfin in Boise, Idaho, said in a statement. "A lot of people are also concerned about the political climate. [They are] holding off because it's unclear where the country will be in six months."

Furthermore, many homebuyers are likely waiting to see if the mortgage rate--currently at 6.49% for the 30-year term--would drop more after the Federal Reserve starts cutting interest rates in September, according to the CME FedWatch tool.

Where Were House Deals Canceled the Most?

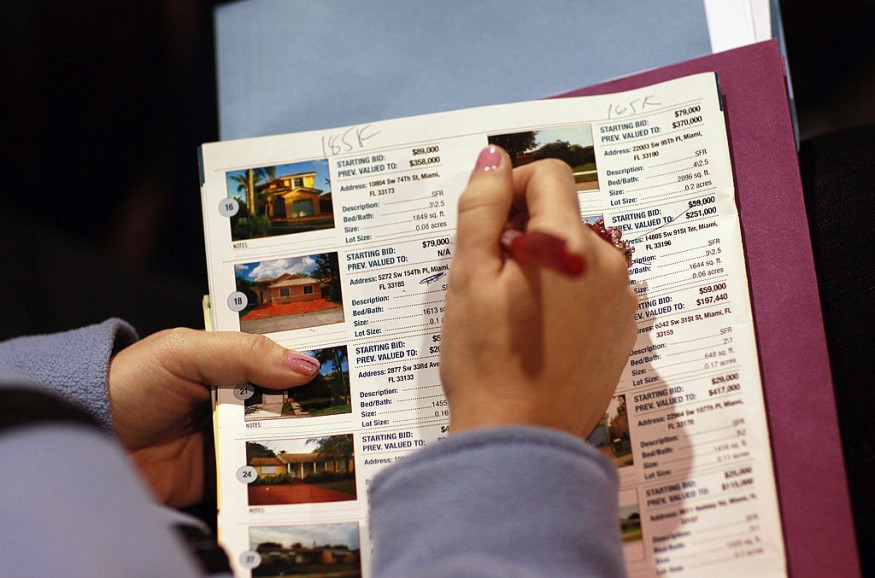

Home buyers in Florida and Texas made up the largest share of buyers who backed out of deals. Tampa, FL, specifically, had 1,266 canceled home-purchase agreements in July. That accounted for 21.9% of all homes that went under contract that month. It also had the highest share of canceled home deals that any other major metro area in the country.

Other metro areas that posted a high share of canceled home-purchase agreements were Fort Lauderdale, FL, (21.8%) and San Antonio, TX, (21.8%).

© 2025 Realty Today All rights reserved. Do not reproduce without permission.