Hurricane Helene destroyed many homes in Florida and North Carolina. The cost of repairs varies but could be very expensive for some. Filing a home insurance claim can help you get the funds needed to repair the damage caused by the storm.

There are processes to know before filing a claim. We created a guide to help homeowners, especially those filing for the first time.

How Much Can You Receive From Insurance?

The amount depends on your particular policy. Insurance companies typically cover any amount over your deductible. Here's an example:

- Deductible: $4,000

- Cost of repair: $60,000

- Amount you'll receive: $54,000

Insurance companies first review claims after filing. They can either approve or deny the claim within 10 to 15 days. Some states may take two months to review a claim.

If your claim is approved, the payment will be sent within 30 to 45 days. This could take up to 60 days in some states. Filing in person could help speed up the process.

Should I File a Claim?

A general rule of thumb is you should only file a claim if you cannot afford to pay for the repairs out of pocket. A filing could prompt the insurance company to raise your rates. Also, filing many claims could lead them to cancel your policy.

"You'll look like a risk," consumer analyst Penny Gusner said. "Depending on how large the claim is and how many you've had, your insurer may 'nonrenew' you for the next period."

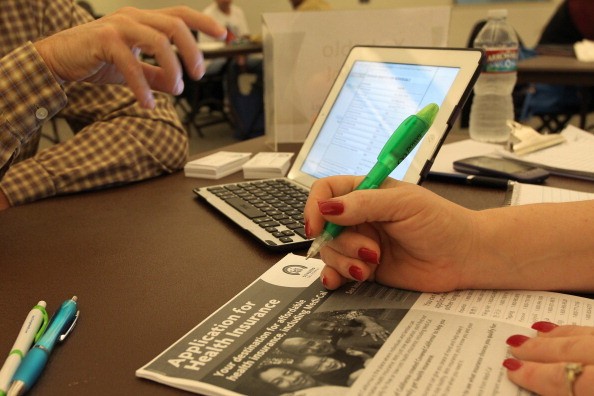

What Should I Prepare for Filing a Home Insurance Claim?

Homeowners who come with the necessary documents prepared can get their claims faster. Here are some documents to prepare:

- Filled and signed claim form

- A copy of your insurance policy document

- Photos or videos that show the damage

- Inventory list of damaged or lost items

- Estimated value of damaged items

- Police report (if there is theft or vandalism involved)

- Fire brigade report (If the damage was caused by fire)

- Proof of ownership

- Repair estimates and bills

© 2025 Realty Today All rights reserved. Do not reproduce without permission.